Despite all the whispering & uprising movements, which challenges Middle East & North Africa (MENA) region stability by large, the truth is its growing. Although, growth varies widely across the MENA region.

There are mainly two blocks within MENA region, one is oil importing countries & the other is oil exporting countries.

GDP Growth:

MENA has 5.0% share in World's total GDP, based on purchasing power parity (PPP).

In next couple of years, it is expected that MENA region will grow in tandem with World growth rate; better than advanced economies but significantly lower than emerging & developing economies.

GDP in the MENA region is projected to grow at 4.1% in 2011, edging up to about 4.2% in 2012. In the group of oil exporters, growth is expected to pick up to 4.9% in 2011 while in the group of oil importers, GDP will slowdown to 1.9% in 2011. In 2012, Oil importers economy will strongly bounce back to 4.5%, on the other hand oil exporters group’s economic growth will take a small dip to 4.1%.

Real GDP Growth | |||

(Annual percent change) | 2010 | 2011F | 2012F |

World | 5.0 | 4.4 | 4.5 |

Advanced Economies | 3.0 | 2.4 | 2.6 |

Emerging & Developing Economies | 7.2 | 7.3 | 6.5 |

Middle East & North Africa | 3.8 | 4.1 | 4.2 |

Oil Exporters | 3.5 | 4.9 | 4.1 |

Iran | 1.0 | 0.0 | 3.0 |

Saudi Arabia | 3.7 | 7.5 | 3.0 |

Algeria | 3.3 | 3.6 | 3.2 |

United Arab Emirates | 3.2 | 3.3 | 3.8 |

Qatar | 16.3 | 20.0 | 7.1 |

Kuwait | 2.0 | 5.3 | 5.1 |

Iraq | 0.8 | 9.6 | 12.6 |

Oil Importers | 4.5 | 1.9 | 4.5 |

Egypt | 5.1 | 1.0 | 4.0 |

Morocco | 3.2 | 3.9 | 4.6 |

Syrian | 3.2 | 3.0 | 5.1 |

Tunisia | 3.7 | 1.3 | 5.6 |

Lebanon | 7.5 | 2.5 | 5.0 |

Jordan | 3.1 | 3.3 | 3.9 |

Only major Oil exporting & importing countries mentioned

Source: IMF, April 2011

Amongst resource rich region; GCC, it is expected that Qatar’s economy will shine both in near term (2011-2012) & medium term (2011-2016) while UAE will lag in the GCC region.

Source: IMF, April 2011 |

Inflation:

As global phenomena for most of the economies in the World, inflation is on the rise in the MENA region too, as higher commodity prices lift headline inflation to 10.0% in 2011 & then declined to 7.3% in 2012, led by mainly Iran & Egypt.

MENA Economies: Consumer Prices | |||

(Annual percent change) | 2010 | 2011F | 2012F |

Middle East & North Africa | 6.9 | 10.0 | 7.3 |

Oil Exporters | 6.7 | 10.6 | 7.1 |

Iran | 12.5 | 22.5 | 12.5 |

Saudi Arabia | 5.4 | 6.0 | 5.5 |

Algeria | 4.3 | 5.0 | 4.3 |

United Arab Emirates | 0.9 | 4.5 | 3.0 |

Qatar | –2.4 | 4.2 | 4.1 |

Kuwait | 4.1 | 6.1 | 2.7 |

Iraq | 5.1 | 5.0 | 5.0 |

Oil Importers | 7.6 | 8.1 | 8.0 |

Egypt | 11.7 | 11.5 | 12.0 |

Morocco | 1.0 | 2.9 | 2.9 |

Syrian | 4.4 | 6.0 | 5.0 |

Tunisia | 4.4 | 4.0 | 3.3 |

Lebanon | 4.5 | 6.5 | 3.0 |

Jordan | 5.0 | 6.1 | 5.6 |

Source: IMF, April 2011

Food prices around the global are on upward trend with rising commodity & oil prices. Economies with having higher food weight in consumer price inflation (CPI) basket hurt the most, which leads increase in poverty & social unrest.

Algeria & Egypt has the highest food weights in consumer price inflation (CPI) basket while UAE & Qatar have the lowest

Source: IMF, April 2011 |

In recent times, Middle East headline inflation has raised the most in comparison to other region because of being large food importer.

Rule of thumb is that Oil exporting countries in the region have relatively higher GDP per capita; therefore, food has less weight in their respective CPI basket, relatively.

External Account:

Current account surplus in the MENA region are expected to widen again as the recovery proceeds, driven in part by elevated energy export prices.

The overall regional current account surplus is projected to rise to over 12.7% of GDP in 2011 & then meagrely down to 11.2% of GDP.

As obvious, Oil exporting countries current account will be sky rocketed in 2011 & maintain the pace in 2012 in tandem with the rising crude oil prices while Oil importing countries will take the heat of rising crude oil prices.

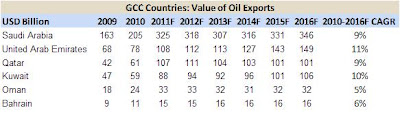

Due to rising oil prices, all the oil exporting countries would take the benefit of it as the value of oil exports are increasing, massively. This would pave the way for the huge fiscal spending in their respective countries.

Source: IMF, April 2011 |

General Government Debt:

Bahrain & then UAE’s general government’s gross debt as percentage of GDP is the highest in GCC region.

Source: IMF, April 2011 |

Fiscal Balance:

All the GCC countries except Bahrain have plenty of room for fiscal spending because of their surplus budgets.

Source: IMF, April 2011 |

National Savings:

MENA Region’s saving is better than advanced & emerging economies which help: a) to finance investments b) In economic woes.

Source: IMF, April 2011 |

Net Financial Flows:

Despite current account surplus, MENA region couldn’t attract private financial flows in recent years.

This is mainly because of non-openness of region’s economies & lack of depth in their capital markets

Final Thoughts:

In MENA region, for oil importers, the main priority should give to raise growth and tackle chronically high unemployment, especially among young people. For oil exporters, the focus should be to strengthen or develop financial systems and promote economic diversification.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.